Cash Flow Demands

Margins can be tight, schedules demanding, and costs variable. Securing a loan for plant and machinery over a suitable term and with repayments that do not pressure cash flow, can be vital for business profitability.

Integral to all these is typically, affordability and profitability. With the overall investment costs considered against cash flow and turnover forecasts. A major part of those considerations and planning can be the cost and structure of the plant and machinery finance.

As specialists in industrial equipment financing with a vast customer base, we work with individual operators to achieve their objectives with affordable, cost-effective financing. Focussing intently on securing the lowest interest rate, and structuring terms and payment schedules to deliver a loan for plant and machinery customised for that operation. To discuss your specific funding requirements, contact one of our brokers by phone or online.

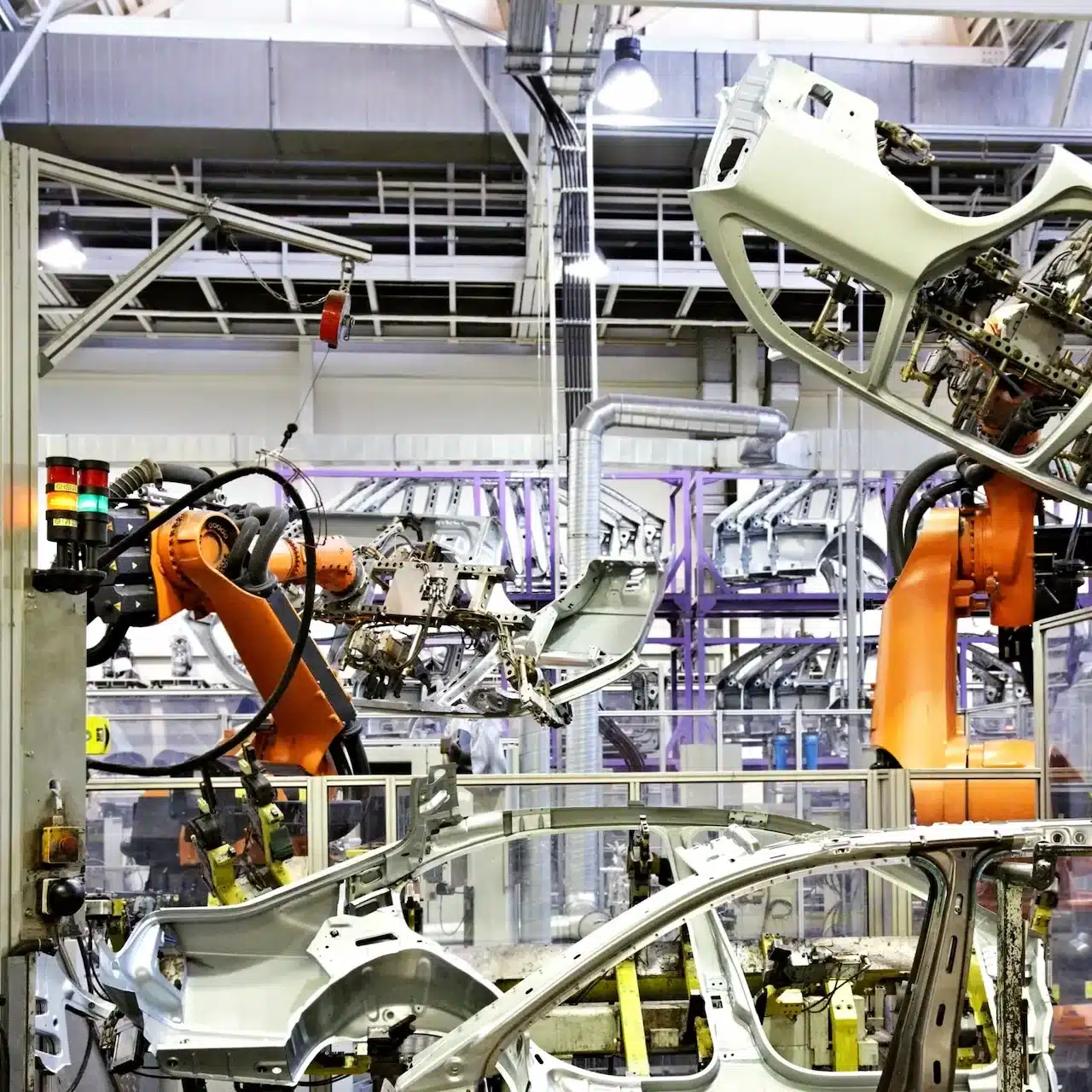

The funding of major assets – plant, machinery and equipment, can be critical to a business particularly in the manufacturing and construction sectors.

Request a Quote

Margins can be tight, schedules demanding, and costs variable. Securing a loan for plant and machinery over a suitable term and with repayments that do not pressure cash flow, can be vital for business profitability.

Across the commercial lending market, there can be variations in the rates, terms and conditions, for operators in different industries, and for specific items of machinery.

Knowing which lender is best suited to a particular industry or business profile can be integral to the financing outcome.

As experts in industrial equipment financing, we have the lenders and the experience across many sectors including agriculture, construction, manufacturing, engineering, logistics, processing, mining and others.

We work with all types of business set-ups – from the largest concerns to the smallest sole traders, to achieve a workable financing solution for the investment.

For a quote on your plant machinery finance, submit an online request or call to discuss your options over the phone.

For a quote on your plant machinery finance, submit an online request or call to discuss your options over the phone.

Our guides offer quick comparisons and simple explainers to help you power through the financing process with confidence.

Selecting the most suitable asset acquisition credit facility is essential. We provide a complete portfolio of products for financing plant equipment with loan options to suit all business structures. Operators can selection from Chattel Mortgage, Leasing, Rent-to-Own and Commercial Hire Purchase. No Doc and Low Doc options can be sourced for new operators.

The differences with these facilities include: compatibility with accruals or cash accounting method, tax deductions, balance sheet posting, ownership of the asset over the financing term, and interest rates. All options can suit all types of business structures, and operators are advised to discuss which is the best option for them with their accountant.

Our brokers secure all industrial equipment financing at a fixed interest rate and negotiate fixed terms up to 84 months to deliver a repayment structure to suit the individual operation. Balloons, buybacks and residuals are available and structured to meet specific objectives.

As highly trained and skilled financing specialists, our brokers are up to date with the latest tax rulings on asset acquisition financing. Solutions are structured to optimise the available tax benefits at the time of applying for the loan for plant and machinery.

Monthly payments on Leasing and Rent-to-Own are fully deductible. Commercial Hire Purchase and Chattel Mortgage arrangements deliver a tax deduction through depreciation of the machinery. Interest and lender fees and charges are deductible.

For a quote on your choice of plant and machinery finance, contact us for prompt service and personal attention.

Using our specialist industrial equipment financing services can deliver significant benefits to businesses in many industries. We are an Australian owned and based business, offering services across the country. Our brokers know the Australian business environment – the challenges and the opportunities, and work closely with customers to achieve their specific goals.

Our lender base of over 80 banks and non-bank lenders provides business owners with immediate access to a vast lending market and the right lender. We identify the lender that best suits individual profiles, to ensure the most suitable and affordable offer is secured. Lender criteria for approving applications and making rate offers varies considerably across the commercial lending market. Being connected with the most suitable lender can make a significant difference to the loan solution.

Our brokers are expert negotiators and use the leverage we have built-up over our 25+ years in commercial lending, to achieve competitive rates for our customers. We work closely with our lender contacts to structure every loan for plant and machinery to meet the specific objectives of our customer. Covering off on every detail from the rate, to the term, to the balloon, to flexible repayment schedules and fast approvals. Getting financing approved quickly can be critical to the timing of getting new machinery purchased and operational.

Everything is handled on your behalf and in your best interests by one of our brokers with specific experience in your industry. Simply brief us on your requirements, provide the necessary documents and we will proceed with the financing arrangements. Apply today and you may be approved by tomorrow.

Prior to purchasing machinery and to applying for industrial equipment financing, operators can use our Plant Machinery Finance Calculator to prepare budgets for the investment. Quickly and easily converting our current highly competitive best rates into repayment estimates.

Operators can vary the data entered to arrive at a structure for the loan for plant and machinery that will work with their cash flow and towards achieving target ROI. The calculator is available 24/7 online and is free to use and without obligation.

Quick quotes can be requested to clarify the estimates calculated.

Your Jade broker will be assisting you at every step of the application process. Meeting eligibility criteria is the first stage. The essential requirement for all lenders for a loan for plant and machinery is holding a current ABN. New ABN holders are eligible. GST registration is not required by lenders but can be seen as a positive by some.

Commercial credit applications require a range of documentation about the business credentials and financials. These can include bank statements, income tax returns, annual accounts, BAS returns, profit and loss statements and similar. Self-employed and sole traders may be requested to also provide personal financials to support their application. Where a business has traded for less than 12 months, we do have lenders that approve No Docs and Low Docs plant and machinery loans.

Lenders will review the credit profile of the operation and possibly the owner or director credit score also. Good credit scores attract lower rates and can also impact other conditions and terms including the loan amount approved.

To apply for a loan for plant and machinery, provide your financials to one of our brokers and we will handle the process. The right lender will be identified, eligibility confirmed, and a quick quote obtained. When the quote is accepted, the application is processed, and we negotiate and structure the financing arrangements. On acceptance, prompt settlement is arranged.

The entire process is streamlined, personal and fast. Ensuring our customers have their funding asap to proceed with acquiring the machinery they need for their operation. Start Now.

| Lender | Loan Product | Interest Rates From | Monthly Repayment |

| {{Lender}} | {{Loan Product}} | {{From - Advertised Rate}}{{Rate Type}} | ${{Payment Amount}} MONTHLY |

|

{{Lender}}

{{Loan Product}}

|

||

| {{From - Advertised Rate}}{{Rate Type}} | ${{Payment Amount}} MONTHLY | |

THE INTEREST RATE IS CALCULATED ON A SECURED LOAN PREDOMINATELY FOR BUSINESS USE, EFFECTIVE 27/11/2025 AND SUBJECT TO CHANGE. WARNING: THE INTEREST RATE IS TRUE ONLY FOR THE EXAMPLES GIVEN AND MAY NOT INCLUDE ALL FEES AND CHARGES. DIFFERENT TERMS, FEES OR OTHER LOAN AMOUNTS MAY RESULT IN A DIFFERENT INTEREST RATE.

Business equipment can be financed with the choice of Chattel Mortgage, Rent-to-Own, Leasing and CHP.

There can be variations in interest rates offered by lenders based on the industry of operation and in some cases on specific machines.

Self-employed operators with an ABN can be eligible for commercial financing.

Businesses without full financials may contact a broker to source Low Doc and No Doc loan options.

CHP and Chattel Mortgage include tax deductions through asset depreciation and the interest is deductible. Rent-to-Own and Lease have deductible monthly payments.

Variations between loans for new and used machinery may include the interest rate; the loan amount; terms; and security.

Getting approved for the total purchase price of assets is dependent on the lender assessment of the application including the credit profile. No deposit financing is typically available for many operators with good credit history.

Extras such as delivery and commissioning charges may be included in a loan, subject to lender approval.

Online calculators do not distinguish between the credit profiles of users or include lender charges. The estimates obtained can be different from lender offers received.

Terms of up to 84 months are typical for asset financing.