End-of-Term Ownership

Also known as Hire Purchase or HP, this facility enables business operators to own the equipment at the end of the financing term.

CHP Equipment Loans may suit many business set-ups and structures from small sole traders, through SMEs, partnerships, corporations and family trusts. Where a business is new or just setting up, we have access to lenders that offer Low Doc, No Doc and No Financials Equipment HP.

Speak with one of our brokers for the solution we may secure for your business set-up.

The name may imply a rental or hire agreement, but Equipment Commercial Hire Purchase or CHP is a credit facility for financing asset purchases.

Request a Quote

Also known as Hire Purchase or HP, this facility enables business operators to own the equipment at the end of the financing term.

In technical terms, CHP is similar to Lease in that the lender acquires the asset under finance and the business repays the loan with monthly payments.

Over the term of the loan, the operator has full use of the asset and is responsible for all expenses such as servicing, maintenance and operating costs.

CHP has similarities with Chattel Mortgage in that the asset is subject to depreciation in the business accounts.

Interest rates on Equipment CHP are typically on par with Chattel Mortgage across the lending market and a balloon component is an option.

A feature of Hire Purchase Equipment Finance that is unique to this credit facility is that it can suit businesses that implement both the accruals and the cash accounting methods.

We advise customers speak with their accountant in deciding if a CHP Equipment Loan is the most suitable option for their business set-up.

Our guides offer useful information and simple explainers to help you understand the financing process with confidence.

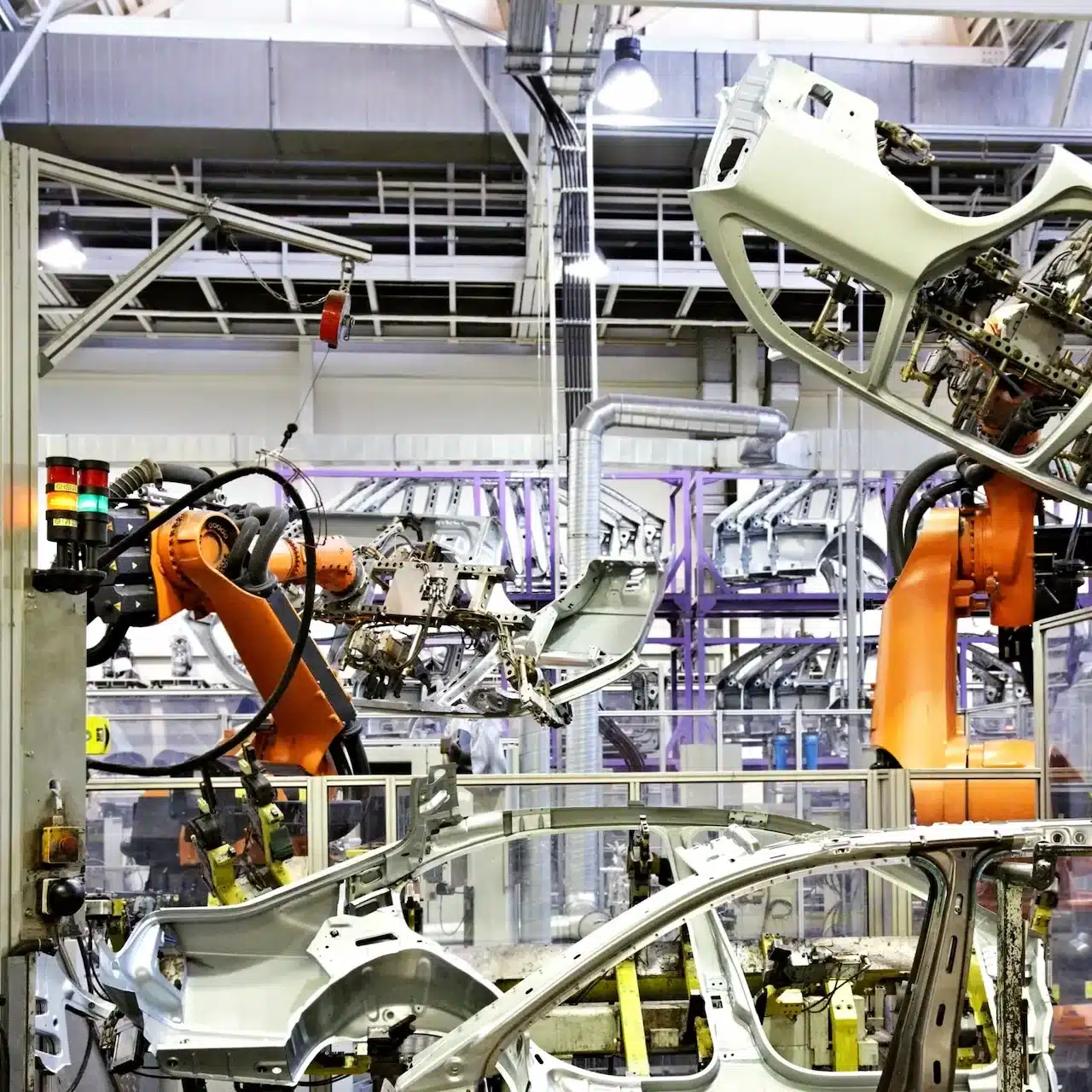

A wide range of both new and second-hand business assets may be suited to financing with HP Equipment Finance. Assets may include plant and machinery used in construction, agriculture, production, processing, logistics, timber industry, civil works and other heavy machinery sectors.

Assets may include computers, IT, fixtures and fittings and general business machines and equipment used in many commercial operations including in the medical field, hospitality, retail and a wide range of sectors. For a quote on Equipment HP for your acquisition, speak with one of our brokers.

| Lender | Loan Product | Interest Rates From | Monthly Repayment |

| {{Lender}} | {{Loan Product}} | {{From - Advertised Rate}}{{Rate Type}} | ${{Payment Amount}} MONTHLY |

|

{{Lender}}

{{Loan Product}}

|

||

| {{From - Advertised Rate}}{{Rate Type}} | ${{Payment Amount}} MONTHLY | |

THE INTEREST RATE IS CALCULATED ON A SECURED LOAN PREDOMINATELY FOR BUSINESS USE, EFFECTIVE 21/02/2026 AND SUBJECT TO CHANGE. WARNING: THE INTEREST RATE IS TRUE ONLY FOR THE EXAMPLES GIVEN AND MAY NOT INCLUDE ALL FEES AND CHARGES. DIFFERENT TERMS, FEES OR OTHER LOAN AMOUNTS MAY RESULT IN A DIFFERENT INTEREST RATE.

CHP is a form of asset acquisition credit which is used to purchase, not rent or hire, business assets such as plant, machinery and equipment.

A balloon is optional with HP. It is a percentage of the loan amount requested which is due to be finalised after the final repayment.

Ownership of goods financed with CHP is transferred to the operator when all payments have been finalised.

The interest portion only of HP payments is deductible. The tax deduction is realised through depreciation of the asset in line with ATO schedules at the time of purchase.

Cash accounting accounts for invoices and expenses at the time they are received or paid. Accruals accounting accounts for invoices when issued and expenses when bills are received.

Commercial credit facilities allow for the assets being financed to be used as collateral for the loan. Whether additional security is required is subject to individual lender guidelines and assessment of the application.

All types of business assets may be financed with CHP. Where IT and computers are considered assets for a business, they may be approved for commercial credit.

Start-up operations without full financials and with turnover for less than 12 months may not meet criteria as set by some lenders. They may seek lenders and brokers that offer Low Doc and No Doc credit options.

A balloon is due for payment in full after the last repayment is made. A balloon may be refinanced, subject to lender approval.

Interest rates on all commercial credit applications are subject to the lender’s assessment of the application and credit score. This includes an assessment of the goods. Rates can vary for new and used goods.