Interest rates can be critical to the viability of acquiring new assets for many businesses. Securing the lowest rates can make essential purchases viable and allow the practice to upgrade their facilities to better meet patient expectations and to deliver the latest treatment protocols. We assist clients to quickly and easily secure those essential best rates with our access to 80+ lenders.

Commercial finance interest rates fluctuate with RBA decisions, economic indicators, with individual lenders and with the profile of the business applicant. Finding the best rates can be a challenge. Using our expert broker services, the process is streamlined and simple.

Our lender panel includes not only major banks, but non-bank lenders with specific areas of expertise, including financing dental equipment. We’re across the market at all times and know which lenders best suit each customer and which lender is currently offering the best rates in key sectors.

With over 25+ years in the commercial lending field, we have earned significant leverage with our key lenders. Leverage that is utilised to negotiate the best rates on behalf of our clients. We handle the entire financing process – sourcing the right lender with the best rates, negotiating on terms and loan conditions, structuring the funding to optimise tax benefits, arranging approvals and liaising between our lender and your supplier for prompt settlement.

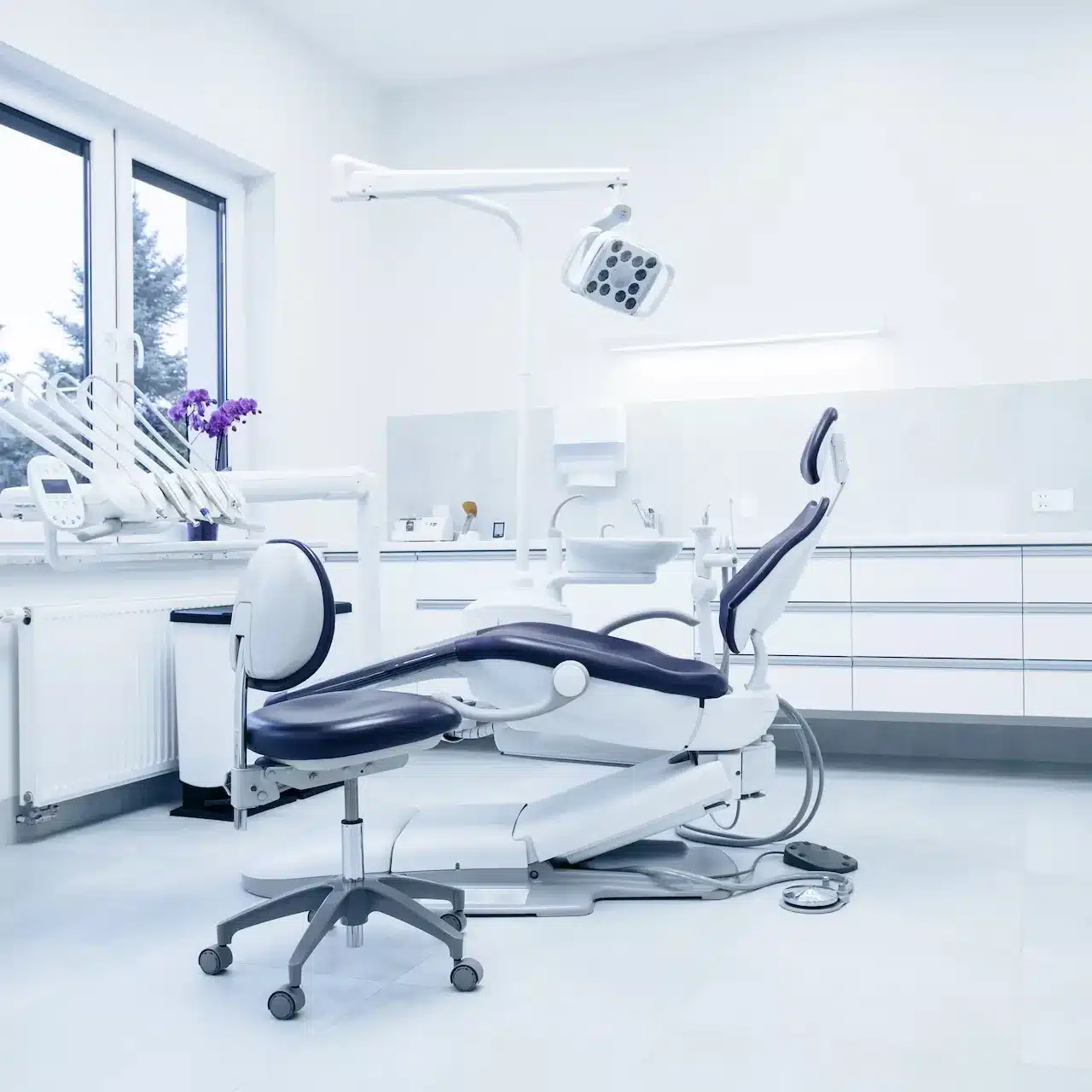

Every aspect of the dental equipment loan is individually handled and managed for clients. Simplifying and streamlining the process of acquiring affordable funding to support practice managers, dentists and specialists.

To realise the benefits of having your dental equipment loan arranged by our professionals, contact us by phone or using our online systems.

- Expert brokers, 25+ years of experience.

- Competitive dental equipment loan interest rates.

- Access to 80+ lenders for competitive rates.

- Individually tailored dental equipment funding solutions.