Flexible Payment Plans

As commercial lending specialists, we provide clients with all types of loans for financing medical equipment. Chattel Mortgage, Hire Purchase, Rent-to-Own and Leasing are available at competitive rates and negotiated terms.

With extensive experience in sourcing financing for medical professionals, we are fully aware of the cost issues which the sector faces in ensuring they have the best available machines and devices to provide patients with the best possible care and treatment. We support the sector with a complete selection of credit facilities, access to specialist lenders, and our vast experience and expertise. Delivering first rate, individually sourced and structure medical equipment finance solutions for a wide range of devices, machines, systems and apparatus.

For personal care and specialist attention to source your finance for medical equipment, contact us directly by simply making a call and speak with one of our brokers or connect with us via our online facilities.

Practices, surgeons, GPs, clinics, centres and therapists have a range of business set-ups with varying objectives when it comes to their loans for medical equipment.

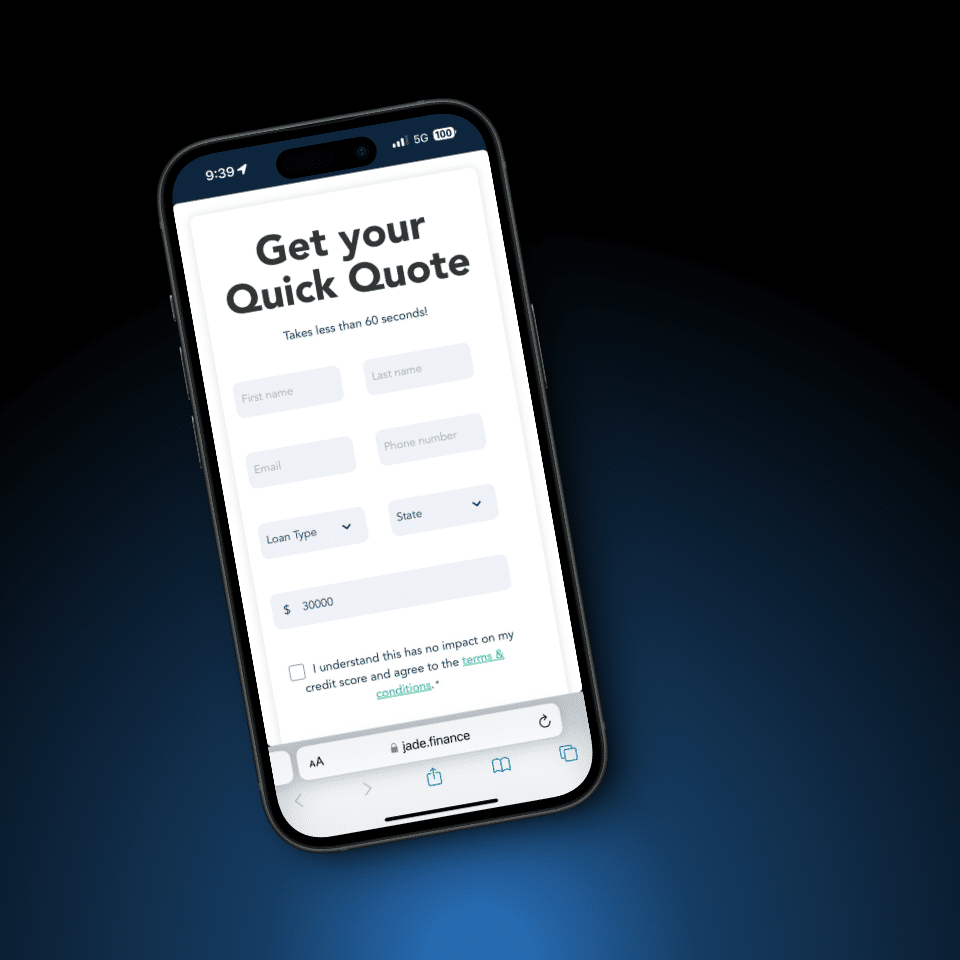

Request a Quote

As commercial lending specialists, we provide clients with all types of loans for financing medical equipment. Chattel Mortgage, Hire Purchase, Rent-to-Own and Leasing are available at competitive rates and negotiated terms.

The exact credit facility can be selected to suit the method of accounting implemented by the practice, their individual approach to owning assets over a credit term, the balance sheet requirements and tax strategy.

Our expert brokers work with our lenders to tailor funding outcomes for individual machines and devices and complete treatment or operating systems. When setting up a new practice, our experts work towards structuring a complete finance package to include all required assets.

Subject to lender approval, the entire equipment expenditure may be included in the loan and the assets accepted as collateral for the financing.

With our extensive lender connections, we have the capabilities to secure the most competitive fixed medical equipment interest rates, workable fixed terms and negotiated balloons to deliver a fixed repayment schedule that works with cash flow projections.

To have your medical equipment financing requirements individually secured and tailored to meet your specific objectives, contact us and brief one of our brokers.

Our guides offer quick comparisons and simple explainers to help you move through the financing process with confidence.

Our services are available to secure funding for all types of healthcare providers on a wide range of equipment. Specifically sourced and tailored funding is available for GP surgeries, specialists, surgeons, health and medical centres, radiologists, pathologists, diagnostics, therapists, day surgeries, clinics and hospitals. Medical equipment loans are available for partnerships, sole practitioners and corporate structures.

Competitive medical equipment interest rates are secured for funding a wide range of asset requirements from the devices and machines through to treatment room furniture, office and reception fixtures and fittings, and IT systems.

For a quick quote contact us online. Or for an offer sourced from our specialist medical equipment lenders call and brief one of our brokers of our specific requirements.

Practice managers sourcing financing for medical equipment will quickly realise that interest rates vary across the commercial lending market. With rates integral to the affordability and possibly the feasibility of essential equipment acquisitions, sourcing the most competitive rates is a high priority. A priority for practitioners and a priority for us.

We have access to more than 80 lenders which include the major banks, other banks, finance companies and specialist medical equipment lenders. Enabling our brokers to cover a vast section of the market to quickly source clients the best medical equipment interest rates.

Our brokers know the lending market, know the criteria used by our lenders when making rate offers, and quickly match each client with the right lender. Ensuring the best rate offers and the most workable finance is secured.

We have built up leverage with our lenders over our 25+ years of experience in the commercial finance sector. Leverage which we use to the benefit of our clients to negotiate competitive rates and the most suitable loan terms. Structuring medical equipment finance that specifically targets client objectives, optimises available tax benefits and works with cash flow.

All aspects of loans for medical equipment are handled individually by our brokers for our clients. Practices, GPs, practitioners, specialists, surgeons, clinics and centres can realise significant benefits using our professional services to source their finance.

Find out how we can deliver benefits for you with affordable medical equipment finance by calling us. Our services are available Australia-wide, delivered by brokers based here in Australia.

Preparing new machine acquisition budgets for partners, managers and boards is simplified with our medical equipment financing calculator. An extremely useful device which assists financial officers, practice managers, office staff and others, to quickly calculate estimates on financing medical equipment.

The calculator can be used to generate repayment estimates, consider varying terms and balloons, and provide figures for planning, preparing and budgeting purposes. It can be used for estimates on all credit facilities, using the current interest rate we are offering on the preferred loan type.

The loan amount may be the purchase price of the equipment with any additional costs incurred with delivery, installing and commissioning.

In many cases, your Jade broker can include these extras in your financing package. For a specific quote for a more exact figure, request a quote.

As specialists in medical equipment financing, we understand and respect the time issues faced by practice managers and finance officers. We provide support with our simplified and streamlined application and approvals process.

On contacting us, customers are assigned one of our brokers with specific experience in sourcing finance for medical service providers. Allowing a single point of contact throughout the entire process. Our brokers handle the entire lending process from your initial briefing through to settlement.

Your Jade broker will detail the specific financial documentation and information required for your application. This generally includes annual accounts, BAS and tax returns, asset and liability schedule, profit and loss statement, and recent turnover. Applications can be made online or over the phone.

We source the best rates and best offer and present the financing package to you for consideration by your decision-makers. Approvals are fast, with many receiving the go-ahead within 24 hours. Applications can be made and approved prior to an actual acquisition to allow forward planning and preparation.

To realise the benefits of sourcing financing for medical devices through Jade, submit a no-obligation application.

| Lender | Loan Product | Interest Rates From | Monthly Repayment |

| {{Lender}} | {{Loan Product}} | {{From - Advertised Rate}}{{Rate Type}} | ${{Payment Amount}} MONTHLY |

|

{{Lender}}

{{Loan Product}}

|

||

| {{From - Advertised Rate}}{{Rate Type}} | ${{Payment Amount}} MONTHLY | |

THE INTEREST RATE IS CALCULATED ON A SECURED LOAN PREDOMINATELY FOR BUSINESS USE, EFFECTIVE 27/11/2025 AND SUBJECT TO CHANGE. WARNING: THE INTEREST RATE IS TRUE ONLY FOR THE EXAMPLES GIVEN AND MAY NOT INCLUDE ALL FEES AND CHARGES. DIFFERENT TERMS, FEES OR OTHER LOAN AMOUNTS MAY RESULT IN A DIFFERENT INTEREST RATE.

All types of equipment, machines, devices, apparatus, IT systems and other assets required by a medical or healthcare provider may be financed with a commercial loan.

Financing all types of equipment can be financed with Leasing, Hire Purchase, Chattel Mortgage or Hire Purchase. Where installation of IT systems is required, it may be included in the same package as the hardware where provided by the same supplier. Where a separate expense, a business loan may suit.

Rates on equipment loans for medical providers vary with the different credit facilities, with different lenders, and with the specifics of the individual business. Rates displayed by lenders may be used as a guide for planning purposes.

Medical equipment may be purchased with the practice’s choice of Leasing, Hire Purchase, Chattel Mortgage or Hire Purchase.

Yes. All assets used by a business enterprise may be financed. This can include furniture, fixtures and fittings.

All commercial credit facilities allow for tax deductions. The way a benefit is realised varies with the choice of facility. Chattel Mortgage and Hire Purchase provide a benefit through asset depreciation. Rent-to-Own and Leasing offer tax deductible monthly payments.

All enterprises with an ABN may be eligible for commercial lending. Different lenders have varying eligibility criteria with turnover figures and time in business.

Asset financing is generally secured with a fixed interest rate which does not change during the loan term.

Subject to individual lender approval, the costs of delivery, installation and commissioning of medical equipment may be included in the financing package.

Yes. Practices may apply for a medical equipment loan before a purchase decision is made or an order placed. The application is conditionally approved with offers finalised when the specific details are available. When purchasing from an overseas supplier, variations may need to be allowed for fluctuations in exchange rates between the time of applying and an invoice being received.