Expert Brokers

Our expert brokers know the lending market and we know the motor vehicle market.

With our personal approach to sourcing finance – assigning one of our expert brokers to each customer – we provide buyers with the opportunity to secure financing for Nissan vehicles that is specifically tailored to their needs.

We provide Nissan loan options for SUVs, hatchbacks, utes, 4WDs and EVs in the range. Competitive low rates on the Juke, hybrid Qashqai SUV, Leaf EV, Pathfinder off-roader, rugged Patrol 4WD, X-Trail medium SUV, Navara cab chassis ute, and the thrilling Z sportscar. If you’re considering one of the exciting vehicles from the Nissan range, speak with us about how we may source you lower rates and more workable funding.

As specialists in the automotive lending sector, we provide a complete selection of Nissan financing products for both business and private buyers.

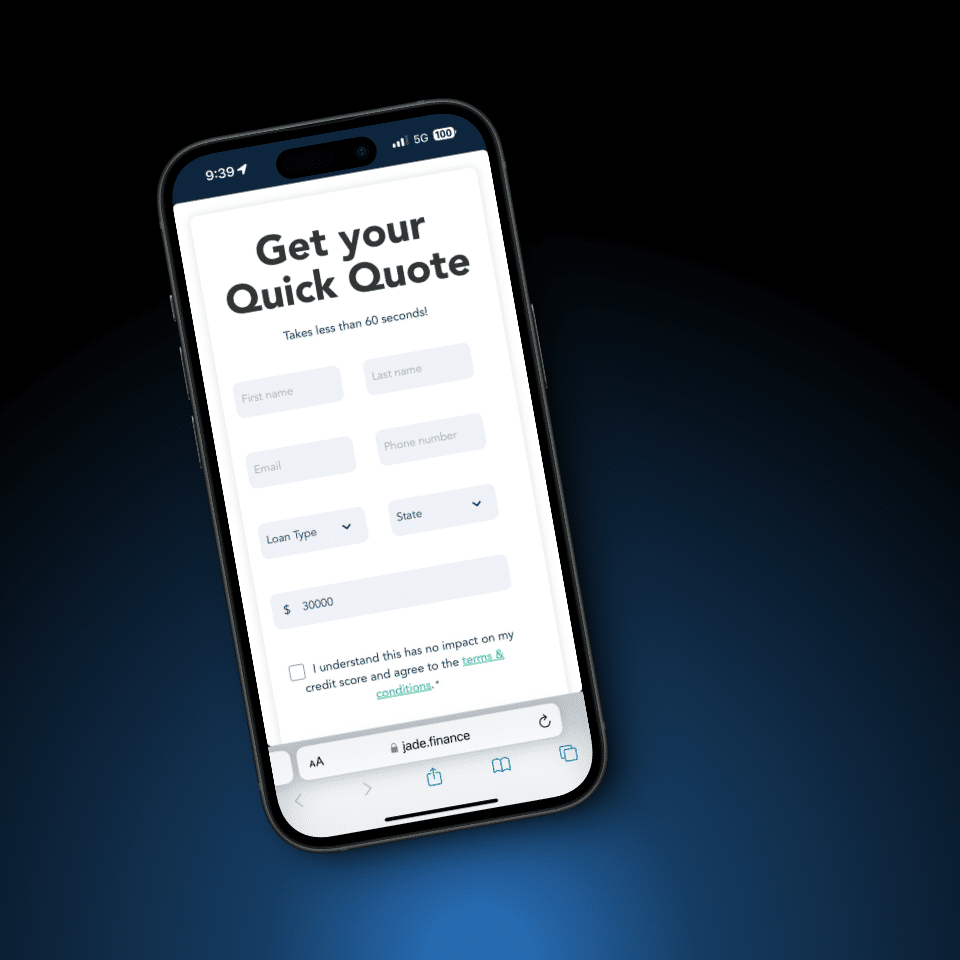

Request Quote

Our expert brokers know the lending market and we know the motor vehicle market.

Using our services provides buyers with a specialist to match their vehicle and individual funding requirements with the right lender.

With our access to over 80 lenders, we can source the lender that best meets individual profiles and is currently offering the best rates and terms on Nissan loans.

Many lenders are now offering green options for EV buyers.

These special offers vary across the market but with our in-depth knowledge and connections, we know what’s currently available and find the best deal for our EV customers.

Our specialist services are available for Nissan buyers across Australia. Contact us online or by phone for a quote on your financing for Nissan vehicles.

Our guides offer quick comparisons and simple explainers to help you cruise through the financing process with confidence.

The Nissan range includes vehicles for both private and business use, for recreation and work, for urban and rural roads. We include lending products that cover all types of buyers, vehicles and business set-ups.

Secured and unsecured credit is available for private buyers with fixed rates, fixed terms and fixed repayments. Business buyers can select the commercial credit facility which is best suited to their business structure, accounting, tax and balance sheet objectives with Lease, Chattel Mortgage, Hire Purchase and Novated Lease with Salary Sacrificing available.

As specialists in Nissan loans, we have access to workable, flexible solutions for new, start-ups, SMEs, self-employed and fleet operators and private buyers applying for their first car loan. Contact us for a quote on your Nissan car loan.

Applying to the right lender from the outset can significantly streamline the application and approval process and minimise the time to get your loan and get behind the wheel of your Nissan. That can start with checking your eligibility with different lenders.

As consumer credit, Personal Nissan car loans are regulated by ASIC which sets out criteria and guidelines for lenders. This includes being over 18 years of age and providing a range of financial information and details. Commercial buyers must have an ABN, ID and provide documentation on their financials.

For all buyers, a good credit score is integral to being offered the lowest rates and financial stability is important to obtaining workable financing for Nissan vehicles. Lenders have their own extra guidelines which can cover minimum and maximum loan amounts, the terms, the trading time for commercial operators and minimum credit scores.

We know the matrix used by our lenders and match each buyer with the most suitable lender. Saving buyers time, effort and any negative impact on their credit score. Buyers that do not meet all lender criteria should speak with us about our possible options for low doc, no doc and bad credit financing.

Contact us today to check your eligibility.

Applying for Nissan car loans with Jade is simple, straightforward and fast. Simply connect with us online or by phone to discuss your specific requirements with one of our brokers. We can quickly check your eligibility for approval and assist you with completing the application.

For the application form, documents including payslips, tax returns, details of expenses, debts, income and ID are required. Once we have the required documentation, we source you the best quote from across our vast lender network. When you accept our offer, we process your application through our fast, industry-level connections with lenders. Many applicants can receive their approval within 24 hours.

On approval, we work with our lender and your Nissan dealer to arrange settlement. Apply online today for streamlined application and fast approval of your Nissan car loan.

Buyers of Nissan vehicles for private use have both secured and unsecured credit options. Secured credit is the most common for new vehicles as the vehicle is used as the collateral for the loan. Saving buyers from using other assets to secured funding. Unsecured credit does not use the vehicle as security, but lenders may require higher credit scores and higher levels of financial stability and creditworthiness for approval.

Both options allow for additional payments to be made and insurance is required on vehicles under finance.

A major benefit of secured and a drawback to unsecured, is the lower interest rates on secured financing over unsecured. Secured vehicle credit is generally available with a fixed interest rate. Unsecured facilities can be at a fixed or a variable rate.

We obtain secured Nissan loans with fixed rates and fixed terms to provide buyers with convenient fixed monthly repayments over the life of their loan. For a quote on personal Nissan car loans, contact us.

We provide commercial operators with the complete selection of credit facilities and individually tailored solutions for Nissan finance. Operators can select from Lease and Hire Purchase, Chattel Mortgage. As vehicle financing specialists, we also offer Novated Leases for businesses seeking to provide vehicles for employees under a salary sacrificing arrangement.

All solutions are structured to optimise tax deductions, work with cash flow and meet individual business objectives. We work with large companies to structure fleet financing to meet their asset acquisition objectives. Structuring terms, balloons, residuals and repayments in line with ownership cycles and resale values.

We also work with the smallest operators – SMEs, sole traders, self-employed, to secure flexible financing that will support their business. Low docs and no docs facilities are available for operators that do not have full financials or have not traded for 12-24 months.

For Nissan financing sourced and structured to your specifications, contact us today.

Dealer financing is available across the majority of the auto sector. It can be seen as convenient by many buyers but is it the best deal available to them? Dealer finance is typically arranged through a specific finance company as designated by the motor vehicle manufacturer. Buyers do not have a choice of lenders with dealer finance. The rates, terms and conditions are subject to those available through that lender.

With Jade, we provide buyers with a large choice of lenders, ensuring we can secure them the lowest rates and the terms and conditions that best match their profile and requirements. Convenience? We offer that to the maximum!

Buyers only need make one call or request a free quote with us and their individually assigned broker handles the entire Nissan finance process.

| Lender | Loan Product | Advertised Rate | Comparison Rate | Monthly Repayment |

| {{Lender}} | {{Loan Product}} | {{From - Advertised Rate}}{{Rate Type}} | {{From - Comparison Rate}}Comparison | ${{Payment Amount}} MONTHLY |

|

{{Lender}}

{{Loan Product}}

|

||

| {{From - Advertised Rate}}{{Rate Type}} | {{From - Comparison Rate}}Comparison | ${{Payment Amount}} MONTHLY |

THE COMPARISON RATE IS CALCULATED ON A SECURED LOAN OF $30,000 FIXED FOR A TERM OF 5 YEARS, EFFECTIVE 28/11/2025 AND SUBJECT TO CHANGE. WARNING: THE COMPARISON RATE IS TRUE ONLY FOR THE EXAMPLES GIVEN AND MAY NOT INCLUDE ALL FEES AND CHARGES. DIFFERENT TERMS, FEES OR OTHER LOAN AMOUNTS MAY RESULT IN A DIFFERENT COMPARISON RATE.

The same credit products apply to both EVs, petrol and diesel models. Some lenders do offer green loans for electric vehicles which may present lower rates or special features.

Interest rates on loans for all Nissan models, including the Z, are determined by the lender’s assessment of the individual application. Good credit score applicants are typically offered the best rates.

Both private and business loan applicants are required to provide details of their financial situation – income and expenditure, assets and debts. ID is required. An ABN is required for commercial credit. Personal loan applicants must be over 18 years of age.

Secured personal vehicle finance and commercial credit facilities are typically arranged with a fixed interest rate. Unsecured vehicle credit may be at a variable or fixed rate. Some lenders may offer variable rates on secured credit.

With new vehicles, the vehicle is usually accepted as the sole form of collateral for secured vehicle credit. Whether extra collateral or personal guarantee is required, is subject to individual lender guidelines.

Leasing features tax deductible monthly payments and Hire Purchase and Chattel Mortgage provide a deduction through depreciation.

Both Lease and Chattel Mortgage are effective commercial credit facilities for vehicles. The suitability of each is subject to the accounting method, tax strategy and balance sheet approach of the individual business operation.

Some lenders offer green car loans for electric vehicles such as the Nissan Leaf. The availability and features of these loans vary across the lender market.

A balloon is the portion of the Chattel Mortgage or Hire Purchase which is scheduled to be paid in full at the conclusion of the financing term.

Novated Car Lease with salary sacrificing is available on Nissan vehicles through brokers and specialist lenders.