Wide Credit Options

While there are a range of different types of low emission vehicles, all can be funded with the same credit options as traditional fuel vehicles.

With our cheaper funding with lower interest rates on all types of electrical vehicles, we may assist buyers reduce the overall purchase cost and potentially maximise their savings over the life of the vehicle.

With over 80 lenders in our lender panel and a specialised team of motor vehicle lending brokers, we source the right lender, the right credit option and the lowest rates for both private and commercial buyers. Speak with us today to see how we can assist you get behind the wheel of your preferred electrified vehicle with cheaper funding.

We provide expert motor vehicle lending services for customers across Australia with all types of funding options.

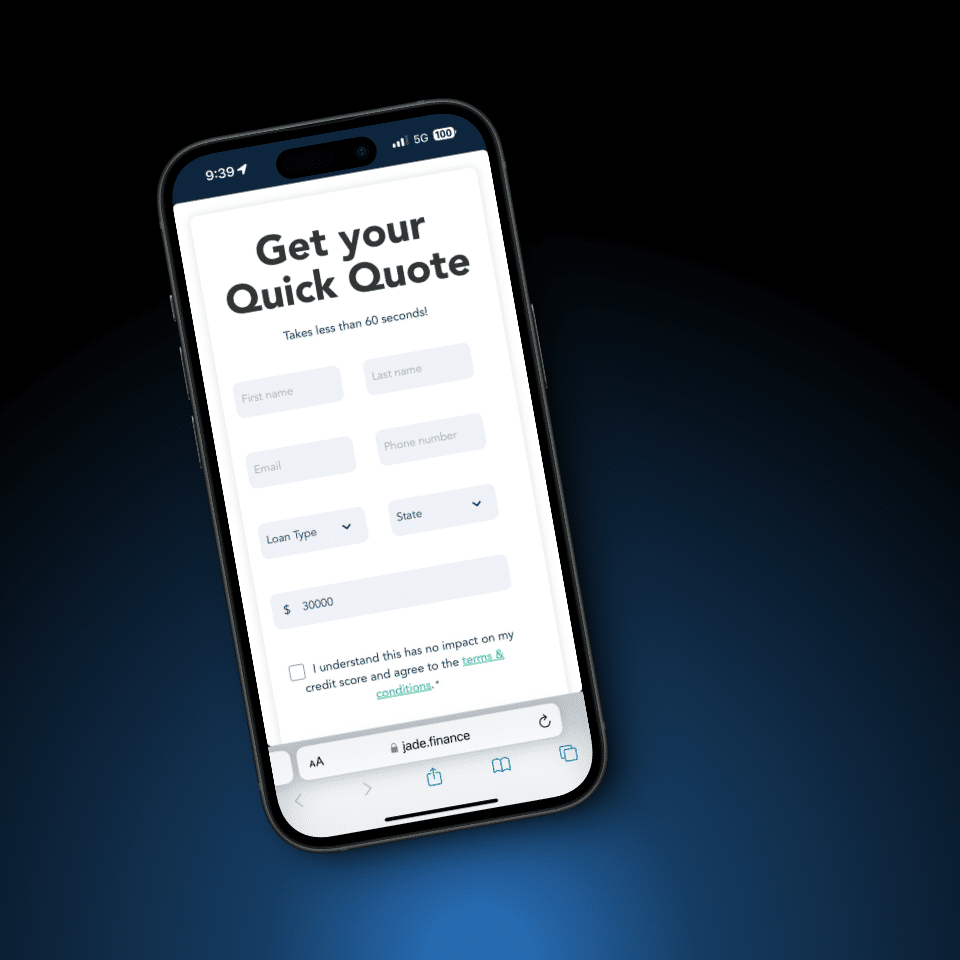

Request Quote

While there are a range of different types of low emission vehicles, all can be funded with the same credit options as traditional fuel vehicles.

As specialists in motor vehicle funding, we offer a complete selection for both commercial and private buyers. Commercial buyers must hold an ABN to apply for credit for electrical vehicles to use in their enterprise.

Regardless of the type of loan, our brokers individually source the right lender to suit the profile and negotiate for the cheapest interest rates.

All funding is secured at fixed rates and over fixed terms to provide fixed monthly repayments. No deposit funding is available.

Buyers located in cities, towns, regional and remote areas can access our cheap rates with our online services.

Prior to purchase or to compare repayments on different electrified vehicle models, simply use our online credit calculator. Whether buying at the lower or the upper end of the market, the calculator can be used to work up estimates on all types of vehicles and all types of loan options.

Our guides offer quick comparisons and simple explainers to help you power through the financing process with confidence.

We assist buyers to minimise their low emission vehicle funding by continually achieving lower interest rates across our credit portfolio. The market for motor vehicle lending in Australia is vast and buyers can face significant time and accessibility issues in trying to source and compare rates on their own. With our extensive lender network, we source the lowest rates currently available to save buyers time and effort. Rates can vary for individual buyers. Refer to our current best rates as a guide and to compare various credit products. To receive the best rate we can source for your vehicle purchase, submit a quote request online or by phone.

Enter the amount you want for your funding, the preferred term, a balloon if a commercial buyer and our current best rate for the credit product of your choice. The calculator instantly calculates the monthly repayments for those values. Vary the values to establish how you would like your funding arranged and contact us for a quote, specific to your application and credit profile. Try the calculator now.

Sales of electrified vehicles have been trending upward for some time as manufacturers continue to add new models to their ranges. Buyers can have their choice of battery-only and hybrid PHEV models across the price spectrum with budget models available, numerous SUVs at varying prices, a selection of commercial vehicles and a broad ranges of passenger vehicles.

We are across the trend and offer funding for all types, brands and models of electrical cars. Our rates for top of the range brands including Tesla and Porsche are extremely competitive with each application individually sourced and negotiated for our customers.

Our secured credit product will suit most private buyers of new electrical vehicles of all types – SUVs, hatches, sedans, battery and PHEV. This product allows for the vehicle to be the security against the credit with many buyers not required to provide additional collateral. Where a used vehicle is not considered as suitable collateral, we provide an unsecured option at highly competitive rates.

Get in touch for a free quote or a conversation around your needs.

Commercial operators can select from a number of funding products with generous tax benefits to further maximise the savings on their electrified vehicle acquisition.

We provide the complete range to suit all types of operators from corporate fleet buyers, SMEs, small operators, self-employed and ABN holders. We recommend that operators speak with their accountant to when deciding which credit product will work best with their set-up, tax approach and balance sheet strategy.

Using our services is not only easy, it is the smart, contemporary way to secure cheaper funding on green autos. Each customer is assigned one of our highly skilled brokers to handle their individual application. Our services are available to all types of buyers of all types of green autos.

Just a single phone call or connection via our online resources and we swing into action to find the cheapest funding for your purchase. We assist buyers with the application, handle all the lender negotiations and will liaise with the dealer to ensure settlement is prompt and timely.

Commercial buyers can be assured that we know financials and we know the latest asset acquisition tax regulations. Vital intel which enables us to structure tax optimised solutions. Optimising deductions to maximise the benefit derived from driving a green auto.

We can provide a free finance quote to help you compare your options.

We are able to secure cheaper rates to ensure cheaper credit through our accreditation with more lenders. With more than 80 lenders in our lender panel, we have the resources to find the cheapest rates on the market and any special offers which may be available for green auto funding.

Some green models can be in limited supply, so buyers with their funding organised can be in prime position to secure their auto. Our fast funding service can provide approvals in 24 hours and prompt settlement.

For a quick quote, before or after purchase, simply connect with us.

| Lender | Loan Product | Advertised Rate | Comparison Rate | Monthly Repayment |

| {{Lender}} | {{Loan Product}} | {{From - Advertised Rate}}{{Rate Type}} | {{From - Comparison Rate}}Comparison | ${{Payment Amount}} MONTHLY |

|

{{Lender}}

{{Loan Product}}

|

||

| {{From - Advertised Rate}}{{Rate Type}} | {{From - Comparison Rate}}Comparison | ${{Payment Amount}} MONTHLY |

THE COMPARISON RATE IS CALCULATED ON A SECURED LOAN OF $30,000 FIXED FOR A TERM OF 5 YEARS, EFFECTIVE 17/11/2025 AND SUBJECT TO CHANGE. WARNING: THE COMPARISON RATE IS TRUE ONLY FOR THE EXAMPLES GIVEN AND MAY NOT INCLUDE ALL FEES AND CHARGES. DIFFERENT TERMS, FEES OR OTHER LOAN AMOUNTS MAY RESULT IN A DIFFERENT COMPARISON RATE.

For commercial credit, applicants must have an ABN. The ATO set out rulings in regard to vehicles used for commercial purposes.

No. The same credit products can be used for funding both battery and PHEV models.

Interest rates on auto funding are based on the assessment of individual applications rather than the fuel system of the auto.

Private buyers of used low emission models can consider secured personal credit. If the auto is not accepted as security, they may consider and unsecured credit option. Commercial buyers have the choice of Chattel Mortgage, Leasing or CHP.

Interest rates on secured auto funding is typically fixed for the full term of the credit.

A balloon is an option with Chattel Mortgage and CHP for commercial buyers.

Using an online credit calculator, buyers can get estimated repayments prior to purchase.

Comparisons of repayments on credit for different priced autos can be done by using an online credit calculator.

No deposit auto credit is available, subject to lender approval. This allows for the full purchase price to be included in the funding.

Luxury low emission vehicles may be funded with secured personal credit or for commercial operators with Lease, CHP or Chattel Mortgage.

For subsidies and rebates for low emission purchases, buyers should refer to their state government for any current offers available. These would typically be claimed after purchase and not allowed for in any funding.

Commercial credit products offer tax deductions. Lease payments are tax deductible. Chattel Mortgage and CHP deliver a tax deduction when the asset is depreciated.

Where a commercial operator does not have full financials, they may seek brokers and lenders that offer No Doc and Low Doc options.

The term on auto funding is subject to lender approval. Up to 7 years may be offered for commercial operators. 4-5 years is a typical term for private credit.

The best option for commercial buyers is the product that suits their accounting method, tax and balance strategy. For private buyers, the secured product is the most widely used option.